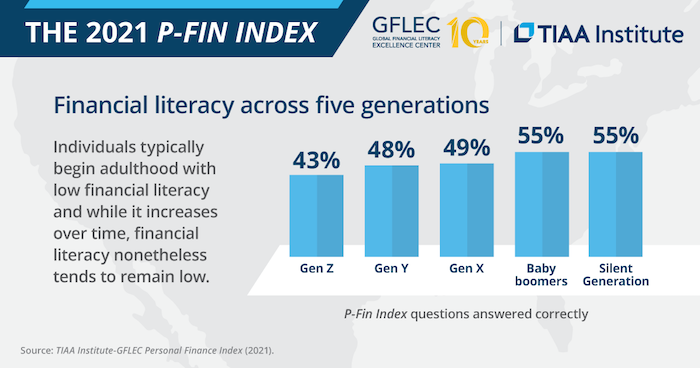

WASHINGTON (October 19, 2021) – Financial literacy is low within each of the five generations—the Silent Generation, Baby Boomers, Gen X, Gen Y and Gen Z—but is the lowest among Gen Z, according to a new report by the TIAA Institute and the Global Financial Literacy Excellence Center (GFLEC) at the George Washington University (GW) School of Business.

While financial literacy tends to be greatest among baby boomers and the Silent Generation, the average percentage of questions answered correctly is nonetheless only 55% among each. Among Gen X, Gen Y and Gen Z, the percentage of P-Fin Index questions answered correctly is 49%, 48% and 43%, respectively.

While Gen Z has the lowest levels of financial literacy, trends across the financial wellness indicators show Gen X faces the greatest financial challenges. Twenty-eight percent of Gen X respondents report having difficulty making ends meet in a typical month—significantly more than any other generation. Approximately 20% of Gen Z, Gen Y and Baby Boomers, and 11% of the Silent Generation report difficulty making ends meet.

“These findings indicate that individuals typically begin adulthood with low financial literacy and while it increases over time, financial literacy nonetheless tends to remain low,” said TIAA Institute Senior Economist Paul Yakoboski. “Furthermore, financial wellness across generations tends to be more compromised among those with lower levels of financial literacy.”

The economic uncertainty created by the COVID-19 pandemic has underscored the need for Americans to improve their personal financial knowledge, and 39% of survey respondents say they are now motivated to focus on their financial literacy. This feeling is more common among younger generations, with Gen Z, Gen Y and Gen X respondents reporting feeling the most focused (52%, 48%, and 44%, respectively).

“The number of Americans who lack financial literacy, particularly in our younger generations, is deeply concerning,” said Annamaria Lusardi, Founder and Academic Director of GFLEC and University Professor at GW. “Until financial education is offered in schools, institutions of higher education, and workplaces, we will continue to see generations of adults struggling with their personal finances.”

The P-Fin Index is an annual barometer of financial literacy among the U.S. adult population. It measures knowledge and understanding that enable sound financial decision making and effective management of personal finances. The P-Fin Index is based on responses to a 28-question survey covering eight areas in which individuals inherently function.

- Earning: determinants of wages and take-home pay.

- Consuming: budgets and managing spending.

- Saving: factors that maximize accumulations.

- Investing: investment types, risk and return.

- Borrowing/managing debt: relationship between loan features and repayments.

- Insuring: types of coverage and how insurance works.

- Comprehending risk: understanding uncertain financial outcomes.

- Go-to information sources: recognizing appropriate sources and advice.

The full report can be found here.

-GW-